OPay, one of Nigeria’s leading fintech platforms with over 60 million users, has unveiled a new suite of seven security features aimed at reshaping how Nigerians manage digital transactions and protect their funds.

Launched in August 2025 under the #MyOPaySecurityVoteChallenge campaign, the features were designed to tackle long-standing issues such as unauthorized deductions, mistaken transfers, and online fraud, common pain points for both bank and fintech app users.

According to Elizabeth Wang, Chief Commercial Officer of OPay Nigeria, the goal was to give customers immediate control and confidence over their accounts.

“The entire process of building this product started with user feedback. Customers need immediate control over their accounts, whether their phone is lost, their card is compromised, or they face unexpected online deductions,” Wang said.

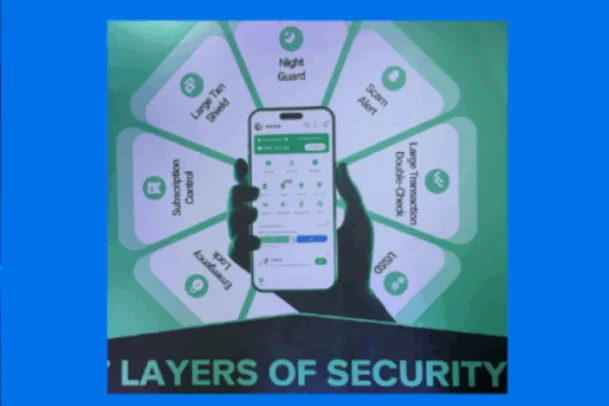

The Seven New Security Features Explained

1. USSD Lock

This feature allows users to instantly lock their account or card using a simple USSD code, especially when a phone or card is lost. Only the account owner can activate or unlock it, preventing unauthorized access.

2. Large Transaction Shield

Before large transfers are processed, users must verify with Face ID, fingerprint, or security code, ensuring funds cannot be moved without explicit confirmation.

3. Emergency Lock

This serves as an immediate safeguard during suspicious activity or theft, freezing the account to block unauthorized transactions until the issue is resolved.

4. Subscription Control

To stop surprise deductions, users can manage and cancel recurring online payments. OPay alerts users whenever a card is linked to a new subscription, allowing full control over automated charges.

5. Night Guard

Late-night transactions now require Face ID verification, preventing unauthorized transfers during off-hours, a period often exploited by fraudsters.

6. Scam Alert

OPay’s real-time fraud detection system checks transactions against a constantly updated database of suspicious accounts, automatically blocking or verifying potential scams.

7. Large Transaction Double Check

For high-value transactions, OPay requires users to re-confirm recipient details or even re-type names, minimizing accidental transfers. If an error occurs, the system can freeze funds and work with banks to reverse it quickly.

The company also revealed that it developed a custom Face ID system for Nigerian users, requiring live motion verification (e.g., nodding or turning the head) to prevent spoofing with static photos.

Addressing Past Challenges

The move comes after reports of unauthorized withdrawals and panic among agents. By introducing real-time control and user-driven protection, OPay aims to rebuild trust and demonstrate leadership in fintech security innovation.

Compared to traditional banks, which rely on slower in-branch verification, and competitors like PalmPay, Moniepoint, Paystack, and Flutterwave, OPay’s new tools stand out for their depth of user-controlled protection and real-time responsiveness.

Expert Insights: Scaling and System Reliability

Fintech engineer and product manager Oluwaseun Oke noted that while OPay’s system is impressive, reliability and infrastructure will be critical as user numbers grow.

“Key risks include system reliability, with databases and APIs struggling with sudden spikes,” Oke said.

“They also depend on third-party providers for services like OTP delivery, so ensuring these partners scale properly is essential.”

He also warned about misuse of the Scam Alert system by users falsely reporting accounts, suggesting OPay enforce stricter validation checks.

Still, Oke praised OPay’s innovation:

“They have one of the best systems in place. The challenge will be talent retention, compliance, and political interference, but they’ve shown they have what it takes.”

User Reactions: Balancing Security and Convenience

For users, reactions to the new system are mixed but largely positive.

Annastasia Njoku, a market trader, appreciates the safety but finds Face ID verification a bit cumbersome:

“They tell you to turn your head right, left, and even say ‘cheese’, it can be stressful while selling in the market,” she said.

Isreal Adebayo, another user, praised the platform’s proactive alerts:

“Whenever I send an unusual amount, OPay double-checks with Face ID and fingerprint verification. It even shows if the recipient’s bank network is stable before I send money.”

Meanwhile, Olubukola Ozone shared how Scam Alert saved him from fraud:

“OPay blocked a suspicious transaction that looked completely legitimate. That one alert saved me from losing money.”