ETAP – a mobility technology company operating in Africa, aims to make getting car insurance as easy as taking a picture.

The InsurTech industry in Africa is young and growing. A 2021 Statista report claims 57 insurtech startups are active in Africa. Surprisingly, most of these 57 startups are located in 3 countries – South Africa, Kenya, and Nigeria, with thirty, fifteen, and four fintechs focused on insurance services, respectively.

Going by these stats, InsurTech companies providing services and solutions related to car insurance in Africa are even smaller.

Guardian also reported that there are indications that only about 2.53 million out of the 12 million registered vehicles on Nigerian roads have genuine motor insurance, leaving about 9.5 million uninsured.

However, among the scarcely localised car insurance providers in Africa is ETAP, a startup making buying and claiming car insurance enjoyable using human behaviour and gamification.

According to the CEO, Ibraheem Babalola, the company is removing the complexities, difficulties, trust and accessibility issues for car insurance, making it possible for people to get insurance for their cars in the space of 90 seconds and get rewards for driving safely

What does ETAP do?

ETAP is a car insurance app that provides insurance services for Africans by providing a fast-tracked process and reward system for customers to have a better experience.

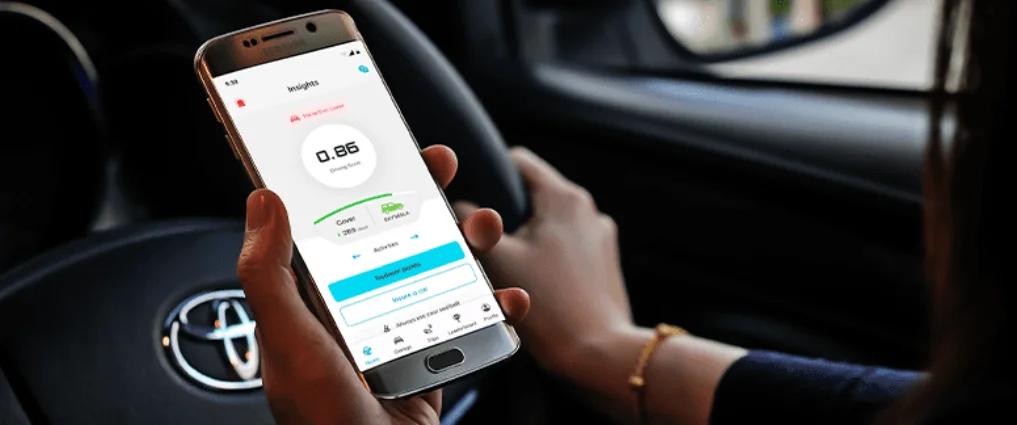

ETAP’s suite of products includes an app that uses advanced telematics to monitor important driving behaviours like speed, cornering, acceleration, braking, and focus. Drivers can also get actional insights and tips to improve their driving while earning rewards for good driving.

Also, users can buy car insurance in a minute and a half, and complete insurance claims in 3 minutes or less, with flexible coverage options including daily, weekly, monthly, quarterly, and annual plans, depending on their needs.

Like its name, which is an acronym for – “easy as taking a picture”, ETAP makes car insurance accessible for the least cost possible through its various services.

What informed the idea behind ETAP?

While many car owners have no or fake insurance, others with genuine insurance papers fail to renew when their policies expire. The Federal Roads Safety Corps (FRSC) Act demands that any automobile on the roads must have at least a third-party motor insurance policy.

For Ibraheem Babalola, despite the growth in banked population and the number of cars that had come into the continent, the existing providers were not leveraging the opportunity and market to tackle challenges of trust issues, accessibility, complexities, availability, and behavioural change, which were some of the issues he saw.

“We have been lucky to be backed by the incredible investors in that space including Toyota Tuosho comany, tangerine Insurance, Crowd ventures and many other interesting investors.”

When was ETAP launched?

According to the company, although ETAP hasn’t officially launched, the company pushed out a public Beta version of the app in November 2021 for users to test and validate the app’s first version that went out of Beta in April.

In his words, he inferred that the concept of launching might be outdated and vague in the sense that launching might be seen from different perspectives. The product has since been available to the public for use since April.

What’s ETAP’s unique offering?

Nigeria has one of the lowest insurance penetration in the world. According to data, Africa’s aggregate insurance penetration rate in 2019 was only 2.78 per cent, compared to the global average insurance penetration rate of 7.23 per cent.

Although traditional insurance companies exist to provide services to provide car insurance, the fundamental problem that has been limiting their efficiency has been the time it takes to get insured and the inability of these companies to meet their mandate.

In this regard, ETAP is going beyond the traditional process and gaining customers’ confidence by offering risk profile-based instant cover, crash notifications, emergency support, instant claims, flexible automated payment plans, and a reward system for driving safely.

The platforms also offer users first-hand opportunity to take control of their safety through the emergency feature, which initiates contact with help in an emergency. In cases where claims are needed instead of useful help, the claims are gotten in the shortest possible time.

How has ETAP built customers’ trust?

It is a well-known fact that many car owners in Nigeria avoid using the services of insurance firms for various reasons. Some people do not understand the process or believe it is not worth the hassle or that providence protects them and car insurance is unnecessary.

Ibraheem Olayiwola explains why ETAP is different from insurance companies. He said that ETAP is not an insurance company but a tech company prioritizing customer experience over everything else. Customers do not feel the pressure to subscribe to the services.

What has the feedback been for the company?

ETAP secured $1.5 million in pre-seed funding to grow its team and drive the adoption of much-needed car insurance across Africa. But asides from that, the platform released to the public in April has also drawn collaboration from MTN.

According to the founder, the feedback has been enormous from users who continuously give positive reviews about the services they enjoy on the platform.

Challenges so far

A major challenge with startups in Africa today is funding and skilled human resources who are conversant with the industry. This plays a major factor in the speed of growth and makeup of the company.

For the founder, the company’s major challenge has been to get people to be aware of the existence of ETAP. He says:

What the future holds

The major goal of any company is to expand beyond borders and gain more recognition for its value. In that direction, most companies seek funding and partnerships to scale up their offerings.

For ETAP, the story is not different. Although already putting plans to scale to Ghana, Babalola claims the product is not just for Nigeria and Ghana alone.