Nigerian digital bank FairMoney has revealed that it disbursed more than ₦150 billion in loans over the past 12 months, while paying over ₦7 billion in interest to savings customers within the same period.

The performance highlights FairMoney’s expanding role in Nigeria’s financial services industry, particularly in digital lending, savings, and financial inclusion for individuals and small businesses.

Evolution From Digital Credit App to Licensed Microfinance Bank

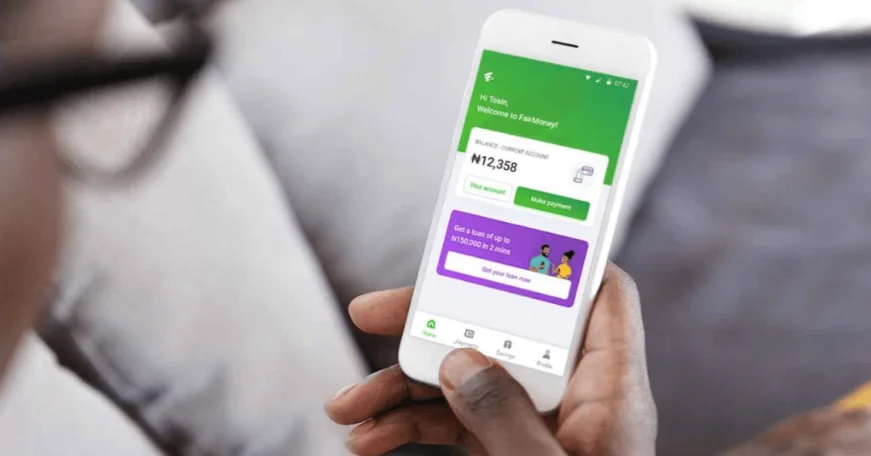

Launched in 2021, FairMoney Microfinance Bank started as one of Nigeria’s early platforms offering instant, app-based loans.

Since then, the institution has evolved into a fully licensed microfinance bank, significantly expanding its product range to include:

- Interest-bearing savings accounts

- Fixed deposit products

- Current accounts

- Debit cards

- POS and merchant payment solutions

These offerings are designed to simplify access to banking services while supporting Nigeria’s financial inclusion agenda.

AI-Powered Lending Without Collateral

FairMoney operates as a technology-driven bank, leveraging AI and machine learning to analyse both financial and alternative data sources, including smartphone usage patterns and customer-submitted information.

Using proprietary credit-scoring models, the bank provides quick, collateral-free loans to individuals and SMEs that may not qualify under traditional banking criteria.

This approach allows FairMoney to assess risk more broadly and extend credit to underserved segments of the population.

Management: Growth Signals Real Economic Impact

Reacting to the figures, Henry Obiekea, Managing Director of FairMoney MFB, said the results reflect the bank’s deeper contribution to Nigeria’s economy.

“Our record loan disbursements and savings interest payments are not just performance metrics, they reflect our determination to support individuals and businesses across Nigeria,” he said.

He added that FairMoney’s savings products are structured to deliver returns that help customers protect their wealth against inflation, especially in a volatile economic climate.

Regulation, Deposit Insurance, and Data Security

FairMoney operates under a licence from the Central Bank of Nigeria and complies with all applicable banking regulations.

Customer deposits are insured by the Nigeria Deposit Insurance Corporation, while data protection and cybersecurity practices align with the Nigeria Data Protection Regulation (NDPR) and industry-grade security standards.

Growth Aligns With Nigeria’s Cashless Economy Push

FairMoney’s expansion coincides with Nigeria’s broader shift toward electronic payments under the CBN’s Payment Systems Vision 2025.

By October 2025, electronic payments reached record highs nationwide, with instant bank transfers accounting for nearly 70% of all digital transactions.

FairMoney says it contributed to this momentum by enabling large-scale digital loan disbursements and consistent interest payments to savers.

Focus on Inclusion and Growth Beyond 2025

Looking ahead, Obiekea said the bank will continue prioritising financial inclusion, trust, and customer empowerment.

“Our work in 2025 was guided by fairness, confidence, and inclusivity,” he said. “As we move into 2026, we remain committed to strengthening Nigeria’s financial system and supporting sustainable economic growth.”